Why the cross-border market needs a local specialist

Buying or investing around the Murray is unique. Postcodes straddle two states, so your options, costs and incentives can change as soon as you cross the river. An albury–wodonga mortgage broker understands how NSW and Victoria rules affect deposits, stamp duty, first home buyer benefits, and even lender appetite for certain suburbs. Add fast-moving interest rates and shifting bank policies, and you have a market where local guidance pays off.

Local buyers often ask two things first. How little can I put down and still be competitive. And which structure suits me if I plan to live in one side of the border and invest on the other. This guide answers those questions with a practical, suburb-aware lens for first home buyers and investors.

Key Takeaway

Use a broker who knows both NSW and Victoria settings so your deposit, duty and loan structure fit the side of the border where you buy.

First home buyer pathways that actually work in Albury and Wodonga

First home buyers in our region have several ways to get in sooner without taking on risky debt. The right path depends on whether you buy in NSW or Victoria, your household income, and whether you are building or buying established.

NSW options to know

The NSW First Home Buyers Assistance Scheme can reduce or remove transfer duty for eligible purchases that meet value caps and residence rules. That duty saving can be thousands of dollars you keep for your deposit buffer or moving costs.

Victoria options to know

Victoria offers the First Home Owner Grant for eligible new homes plus a range of duty concessions and reductions. These include principal place of residence and off the plan concessions that can meaningfully lower upfront costs when the valuation meets criteria.

Low deposit tactics that do not overreach

Borrowers frequently ask if a 5 percent deposit is enough. It can be when paired with lender’s mortgage insurance or an approved guarantee program, but the real trick is making sure repayments still fit your budget under a realistic stress test. Lenders test your loan at a rate above the one you actually pay. Australia’s prudential regulator has kept the minimum serviceability buffer at 3 percentage points, which tells you why a sharp rate cut does not suddenly add unlimited borrowing power.

How your local broker helps

A local broker can compare NSW and Victoria duty outcomes, explain how valuation and build timelines interact with state rules, and pre test your borrowing with the buffer in mind. That prevents nasty surprises if rates or policies change before settlement. Brokers also map out living costs unique to regional buyers, like commuting between sides of the border or building on larger blocks with higher site costs.

Deposit and duty levers at a glance

| Lever or rule | Where it applies | Typical effect on upfront cost | What to confirm before you rely on it | Who it suits |

|---|---|---|---|---|

| Transfer duty concessions for first home buyers | NSW | Reduces or removes duty, lifting your effective deposit | Value caps, residence period, timing of occupancy | Owner occupiers buying entry level homes |

| First Home Owner Grant and duty concessions | Victoria | Grant for eligible new homes plus duty reductions | New vs established, concession type, contract timing | Buyers building or buying new in growth estates |

| Lender serviceability buffer | Nationwide | Limits borrowing by testing a higher rate | Current buffer setting and your household expenses | Anyone close to a max borrow limit |

| Lender’s mortgage insurance | Nationwide | Allows as little as 5 percent deposit on many loans | Premium cost, ability to capitalise, effect on rate | Buyers strong on income but light on savings |

| Family or guarantor support | Nationwide | Reduces or removes LMI and boosts borrowing | Legal advice, guarantor equity and risk | Buyers with supportive family and stable income |

Why pre approval must be border smart

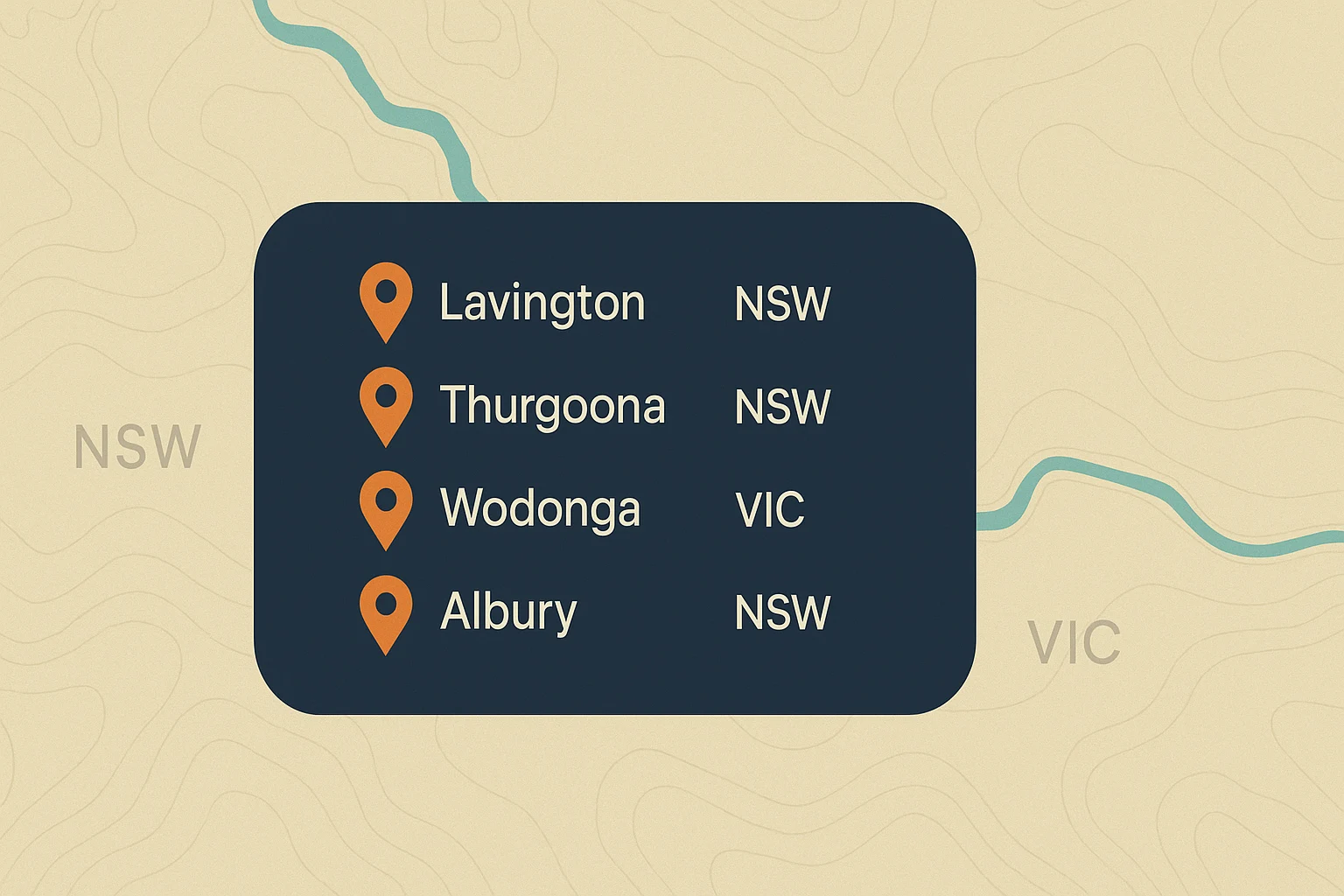

Pre approvals from a lender with strict postcode shading can undercut your budget in certain fringe or semi rural pockets. A local broker will filter lenders that price Albury, Lavington, Thurgoona, Wodonga, Baranduda and surrounding areas fairly, then match your property type to lender policy.

Key Takeaway

First home buyers should model both sides of the river. Duty, grants and lender policy can make a NSW purchase different from a Victorian one even at the same price.

Investment lending in a regional growth corridor

Investors like our region for yields that often outpace capitals and the diverse rental demand from health, logistics, defense, education and cross border services. That said, investment loans are under closer scrutiny than owner occupier loans, and small policy differences can swing your strategy.

Choosing the right loan split

Many investors combine an interest only investment loan with a principal and interest home loan to manage cash flow while paying down their non deductible debt first. Others prefer principal and interest across the board to reduce risk. The right mix depends on your tax position, cash buffer, and whether you may soon refinance to extract equity.

Why buffers matter even in a falling rate cycle

Interest rates move in cycles. Even if the cash rate holds or falls, lenders will continue to test your repayments at a margin above actual rates. The current regulatory setting keeps the minimum stress buffer at 3 percentage points, so an investor who can afford a loan at today’s pricing still needs to prove they are safe if rates rise later. That is by design, and it stabilises credit quality in regional markets.

Suburb nuance matters

- Lavington NSW often offers duplex and house stock that appeal to yield seekers.

- Thurgoona NSW has newer estates, townhouses and family homes near schools and the university footprint, which attracts long term tenants.

- Wodonga VIC blends established areas with infill and new estates, with varied strata rules that can affect lender appetite.

Rental income and tax impacts

Work with your tax adviser on negative vs positive cash flow outcomes and how depreciation affects after tax returns if you build new. A broker can feed them accurate repayment and fee projections so your structure and tax plan match.

Key Takeaway

Investment success here comes from structure and suburb selection. Use a broker to align loan splits, buffers and lender policy with the yield and tenant profile you are targeting.

Refinancing and rate reviews without the gotchas

Refinancing can reduce repayments, simplify your debts or release equity for upgrades or an investment purchase. But switching costs, cashbacks and honeymoon rates make the comparison tricky. Focus on total cost over the next two to five years, not just the sharpest headline today.

How to run a proper refinance check

ASIC’s Moneysmart outlines the core steps for switching home loans, including asking your current lender for a better deal and weighing break fees, discharge fees and application costs against savings. That checklist approach helps you avoid chasing a small rate cut that evaporates after fees.

Where the cash rate fits

The Reserve Bank’s cash rate target influences banks’ funding costs and the rates offered to borrowers, but your actual home loan is set by lender competition, risk pricing and product features. In reviews, benchmark your rate against the cash rate trend to see whether your lender has passed through a fair share of changes. The RBA publishes a definitive cash rate series you can use as an anchor.

Avoiding trap features

- Introductory discounts with expensive revert rates

- Fixed loans with steep break fees right before you expect to sell or renovate

- Package fees that exceed any bonus benefits you use

- Cashbacks that do not cover discharge and new application fees

Timing a refinance around local life

People here often coordinate refinances around lease renewals, school terms or planned relocations between sides of the border. A broker can hold applications until valuation risk is lowest and line up any equity release with trades or builder timelines.

Key Takeaway

Refinancing works best when you compare total cost and timing, not just rate. Follow an evidence based checklist and benchmark against the RBA cash rate series.

How a broker compares to going straight to a bank

A bank can only offer its own products. A broker can compare dozens. That matters in a cross border market where policy quirks, postcode restrictions and build contracts vary.

When a bank may be fine

- You want a basic owner occupier loan with a large deposit and expect to stay put for years.

- You already bank where you will likely get the strongest loyalty pricing and fee waivers.

When a broker is usually better

- You have a low deposit and need to balance LMI against duty savings in NSW or Victoria.

- Your purchase is in a suburb where some lenders restrict appetite or require higher shading.

- You are building and need staged valuations and construction progress payments.

- You want to compare investment structures or bundle personal, car or business lending.

A good broker should also translate policy into plain English and set clear expectations on approvals and timelines. If a lender is likely to order a valuation that comes in short of contract price in a particular estate, you want to know that before you pay for building and pest.

Suburb spotlight for common search requests

Lavington NSW

Buyers often search for a mortgage broker in Lavington because it combines older stock, infill and increasing lifestyle amenity. A local broker will pre check any zoning and valuation notes that affect older houses or dual occupancy blocks.

Thurgoona NSW

Mortgage broker recommendations for Thurgoona typically focus on navigating new estate contracts, potential developer rebates and the way some lenders view smaller townhouses or land size minimums.

Wodonga VIC

Can you get a home loan with a low deposit in Wodonga. Yes, with the right mix of income, LMI or eligible guarantees and a lender that prices Wodonga correctly. A pre approval that reflects Victoria duty concessions can also stretch your budget more than you think when compared with NSW, depending on price and whether the home is new.

Albury NSW

What are the best mortgage rates in Albury. The sharpest rate changes week to week. A broker compares multiple lenders at once and weighs features, fees and cashbacks against your plans. Savers should remember the RBA cash rate is only one input to product pricing, not the whole story.

Practical prep list before you apply

- Three months of income evidence and living cost history that match your declared budget.

- A clear deposit narrative. Savings, gifts, sale proceeds or equity release must be documented.

- A property shortlist with both NSW and Victoria options if you are early in the search.

- A timeline for move in, lease end and any construction milestones.

- A rate and fee target that reflects your must have features and your nice to haves.

Why this matters

Strong documentation leads to fewer lender questions, faster approvals and better pricing. It also helps your broker model the loan the same way the lender will test it, including the current serviceability buffer.

Frequently asked local questions

Who is the top rated mortgage broker in albury–wodonga. Ratings change and depend on the platform and the criteria used. Look for verified reviews, clear disclosure on lender panel size and a willingness to say no if a product does not suit you. Shortlist two or three and compare advice, not just star counts.

Can I get a home loan with low deposit in Wodonga. Often yes. Many lenders will consider 5 percent deposit loans when paired with LMI, and some guarantee pathways may reduce or remove LMI for eligible buyers. Ensure repayments still pass the lender’s buffer test and that you have a rainy day fund after settlement.

Which mortgage broker helps first home buyers in Albury. Plenty of local brokers specialise in first home buyers. Focus on those who can explain both NSW and Victoria duty and grant settings in simple terms and who provide a written game plan from pre approval to settlement.

How do I refinance my home loan in albury–wodonga. Start with a rate and fee check, ask your current bank for a sharper offer, then assess whether the savings exceed the switch costs. A practical switching checklist keeps the focus on total value, not just headline rates.

What are the best mortgage rates in Albury NSW. There is no single best rate. Use the RBA cash rate as context, then compare multiple lenders and product features side by side. A broker can request pricing from a few banks on the same day so you see a fair comparison.

Find a mortgage broker in Lavington NSW. Search locally and ask about recent approvals in your target streets. An albury–wodonga mortgage broker who has settled loans in Lavington recently will know which lenders are valuing there competitively.

Who can help with investment property loans in Wodonga. Choose an investment savvy broker who will model interest only vs principal and interest, expected rent, buffers and exit plans, then check lender policies on property type and postcode.

Is it better to use a mortgage broker or bank in albury–wodonga. If you want choice and policy translation across borders, use a broker. If you are wedded to one bank and have strong loyalty pricing, going direct can be fine. The key is comparing total cost and flexibility.

Can a mortgage broker help with bad credit in Wodonga. Yes. Many have access to specialist lenders that consider paid defaults or unusual income. Expect tighter terms and rates at first, with a plan to improve pricing after clean conduct.

Putting it all together for first home buyers and investors

You can buy with a smaller deposit if your income and budget stack up under a realistic stress test. You can structure an investment loan for tax and cash flow without overleveraging. And you can refinance for better value when timing and fees align. The common thread is getting suburb aware advice and using both NSW and Victoria rules to your advantage.

If you are ready to take the next step, book a 20 minute review with a local expert who will check your borrowing power under today’s buffer, map out NSW vs Victoria duty outcomes and shortlist lenders that price your suburb fairly. That is the path to confident decisions in a market that rewards preparation.

About rates, buffers and guidance sources

- The RBA publishes the official cash rate series and charts you can use to track context for rate reviews.

- APRA sets key macroprudential settings, including the current 3 percentage point minimum serviceability buffer lenders apply when testing new loans.

- Government guidance on home loans and switching is available through official channels.

- NSW and Victoria first home buyer concessions and grants are outlined by the state revenue offices. Review their eligibility pages before you rely on a benefit.

Final checklist before you call a broker

- Know your side of the border and whether you are open to both.

- Write down your maximum safe repayment, not just the bank’s number.

- Gather income and expense evidence for the last quarter.

- List the top three features you care about most.

- Decide whether you want to live in now or invest first.

Ready to get started

Get your free pre-approval check and cross-border strategy session. Humble Finance Brokers specialises in NSW and Victoria property purchases with access to 40+ lenders and proven results across Albury, Wodonga, Lavington and Thurgoona.

Book your consultation:

- Call (02) 6061 4599 for same-day advice

- Visit 13/495-499 Dean St, Albury NSW 2640

- Online enquiry at humblefb.com.au - response within 4 hours

Family owned. Local expertise. Clear answers.