Start with your goals, not the lender

If you are buying, refinancing, or investing around the Coffs Coast, the right partner is a broker who translates your goals into a loan strategy that fits your life. A good Coffs Harbour mortgage broker will map your target property, deposit, cash flow, and risk comfort to the lenders whose rules actually match you. That sounds obvious, but lender policy is a moving target and small details decide approvals. The same borrower can be a yes at one bank and a hard no at another because of how overtime income is shaded, how addbacks work for sole traders, or how rental income from a granny flat is treated.

What does a broker do in practice? They compare products, but more importantly they interpret policy. They estimate borrowing power, check serviceability buffers, flag property risks, and design an application that makes a strong case. Brokers in Australia must act in your best interests when recommending a loan, which means the loan they suggest should align with what you need rather than what pays the most commission.

Buying around Coffs Harbour also has local quirks. Prices and incomes vary between Coffs Harbour, Sawtell, Woolgoolga, and Bellingen. Holiday let potential and property type can influence lender appetite. A broker who knows the Mid North Coast can warn you early if a property type is hard to fund or if the lender valuation might come in short.

Key Takeaway

Start by defining your goal and constraints, then choose a Coffs Harbour mortgage broker who can translate that brief into lender policy, rather than chasing a headline rate in isolation.

Rates, rules, and the 2025 lending backdrop

Every loan conversation starts with the rate environment and the rules that govern how much you can borrow. As at mid August 2025, the Reserve Bank’s cash rate target is 3.60 percent. Mortgage rates are priced off that anchor, so understanding the cash rate helps you read lender moves. The RBA’s August Statement on Monetary Policy confirmed the 3.60 percent setting and explained why conditions warranted that decision.

Even if advertised rates drift down, your borrowing capacity still has to clear a regulator set buffer. APRA currently expects lenders to test new borrowers at an interest rate at least 3 percentage points above the actual rate you will pay. This safeguard is one reason your borrowing limit may feel lower than your back of the envelope math. Knowing the buffer early lets you adjust price targets or deposit planning rather than being surprised later.

Rate talk often misses two practical numbers your broker will surface for you: the comparison rate and the real cost over time. Comparison rates factor in some fees so you can compare loans more fairly. The true cost analysis goes further by weighing offset benefits, refinance rebates, package fees, and your plan to pay down debt faster. A broker who models both will stop you from picking a low headline rate that is not actually the lowest cost.

Finally, Coffs Harbour has a mix of houses, townhouses, and apartments across flood and bushfire zones. Some lenders have stricter risk flags in specific postcodes or for units under a certain size. Ask your broker to run those checks early, especially for off market opportunities where you need to move fast.

Key Takeaway

Rates set the tone, but capacity hinges on regulator buffers and lender policy. A broker who models comparison rates and real costs helps you pick a loan that stays affordable if conditions change.

First home buyers and current government support

If you are purchasing your first home in NSW, two frameworks matter in 2025. The first is the state transfer duty settings for first home buyers. Under the First Home Buyers Assistance Scheme, eligible buyers can receive a full exemption or discounted duty, which can materially change your deposit plan. Your broker will factor the duty estimate into your target property price and cash on hand.

The second is the federal Home Guarantee Scheme administered by Housing Australia. From 1 October 2025, the scheme expands with unlimited places and no income caps, alongside higher property price caps. That means more buyers can purchase with a smaller deposit while avoiding lenders mortgage insurance, provided they meet lender credit rules. A broker who is accredited with participating lenders can check eligibility and place you with a lender that has scheme allocations available. Use the official eligibility information as a guide, then let your broker validate your position with a credit assessment.

If you are weighing regional choices across Coffs Harbour, Sawtell, and nearby towns, your broker can compare which purchase price range aligns with both scheme caps and your borrowing power after the APRA buffer. The result is a short list of suburbs and property types that fit your budget and settlement timeline.

Where a broker adds extra value for first home buyers

- Translating scheme rules into a property shortlist that matches price caps and duty thresholds.

- Checking postcode and property risk policies before you spend on building and pest.

- Structuring pre approval so you can bid with confidence and short finance clauses.

- Coordinating with your conveyancer so scheme timing, contracts, and valuations line up.

Key Takeaway

Use a broker to integrate NSW duty concessions and the federal guarantee settings with your real borrowing power so your shortlist only includes properties you can win and comfortably service.

Which lending path suits your scenario

Every borrower profile suggests a different lender shortlist and application strategy. Use this table to get oriented, then lean on your broker to test policy and pricing.

| Scenario | What a broker examines | Likely path | Documents that help | Watch outs |

|---|---|---|---|---|

| First home buyer | Deposit, gift vs savings, scheme eligibility, duty | Lenders with strong pre approval and scheme allocations | Savings history, ID, payslips, bank statements | Property caps and settlement timeline |

| Self employed | Trading history, addbacks, BAS seasonality | Lenders with flexible income averaging and alt doc options | Tax returns, BAS, management accounts, ATO portal | Variability in income shading and verification |

| Bad credit or thin file | Defaults, repayment history, score trends | Non bank or specialist policy with rebuild plan | Credit report, hardship letters, bank conduct | Higher rates initially, refinance plan needed |

| Refinancing | Current rate, revert rate, equity, break costs | Mainstream lenders offering sharp pricing and offset | Current statements, property estimate, ID | Fixed loan break fees and valuation risk |

| Investment property | Rental yield, expenses, negative gearing impact | Lenders with realistic shading of rental and expenses | Lease or estimate, tax schedule, property statement | Higher assessment rates and buffers |

| Weekend or after hours needs | Work schedule, time zone, urgency | Broker who offers flexible meeting times | ID ready, summary of goals, estimate of income | Fewer lender call backs on weekends |

Why a local broker matters for Coffs Harbour and Sawtell

- Local lenders and credit teams sometimes move faster on familiar postcodes.

- A local broker knows which strata or property types have flagged issues.

- If you are searching in Sawtell NSW, ask your broker about comparable sales and valuation dynamics, since lender valuers lean heavily on these when margins are tight.

Key Takeaway

Match your scenario to lender rules. A Coffs Harbour mortgage broker with broad panel access can open more yes paths, then stage a refinance later if a specialist lender is the only initial approval.

How to work with a broker like a pro

You can speed up your approval and improve pricing by prepping like this.

1. Define success and your non negotiables Spell out your maximum budget, ideal repayment, plan for extra repayments, and any must have features like an offset account. Decide how much cash you want to keep in your emergency buffer after settlement. When your broker asks for a target repayment and a stretch repayment, give both.

2. Collect documents up front For PAYG, gather your last two payslips, most recent group certificate or income statement, ID, and 3 months of bank statements. For self employed, add your last two tax returns, current year BAS, and management accounts. Clean bank conduct and clear explanations for any late payments make you look stronger.

3. Get pre approval before you make offers A robust pre approval gives you confidence to move quickly and it signals to selling agents that you are serious. Ask your broker how long the pre approval is valid and what conditions must be met after you sign a contract.

4. Compare product fit, not just the headline rate Ask your broker to show the comparison rate and a three year cost model factoring fees, potential refinance cash backs, and offset benefits. Use this to choose the structure that fits how you manage cash.

5. Understand buffers and what if scenarios Because lenders must test you at a higher assessment rate than your actual rate, ask your broker to run a stress test showing your repayments if rates rose by 1 to 2 percent from today. This gives you confidence that your plan still works under pressure.

6. Keep communication tight once you sign Your broker will shepherd valuation, unconditional approval, and settlement. Reply quickly to document requests and keep your credit activity quiet until settlement. If you need weekend meetings, choose a broker who offers flexible appointments and is comfortable working around Coffs Harbour and Sawtell Saturdays when open homes peak.

Broker vs bank in plain language

Should you walk into your everyday bank or use a broker? There is no one right answer for everyone, but brokers offer two core advantages. First, they compare across multiple lenders in one go, which raises your chance of approval at a competitive total cost. Second, they are legally required to act in your best interests when recommending a loan. Direct bank lending can be fast if you fit that bank’s box, but a single bank cannot tell you if another lender would do better for your scenario.

If you lean toward your bank, ask them to explain any policy exceptions they can offer and request a pricing review. Then ask your broker to benchmark that offer. Having both options can only help you.

Refinancing without regrets

Refinancing is not just about shaving a few basis points off your rate. The goal is to improve your position. Your broker will check your current revert rate, fees, and the usefulness of features like an offset. They will weigh any refinance rebate against closing costs and a realistic valuation of your property in Coffs Harbour or Sawtell. If your current lender will price match, that can be the simplest path. If not, your broker can line up a clean refinance with minimal churn. ASIC has long advised consumers to ask how a broker is paid and to use calculators to compare switching costs. That mindset still makes sense in 2025.

If you had late payments or a change in income during the last year, do not assume you are stuck. Specialist lenders may approve a refinance with a plan to clean up conduct and refinance again into a mainstream bank in 18 to 24 months. Your broker can map the stepping stones and tell you exactly what bank conduct will put you in the best position when the time comes.

First home buyer paths that work in 2025

If you are entering the market this year, there are two models that often work well in Coffs Harbour.

Starter home with scope to add value Look for a liveable property in a suburb you like with room to add a bedroom or upgrade the kitchen over time. Your broker will size the loan so you can afford those improvements later. If you are eligible for duty concessions or a federal guarantee, that can reduce your upfront cash. Confirm scheme rules and price caps before you make any offers.

House plus a rentable space Some buyers aim for a property with a studio, granny flat, or ability to add one. Lenders vary in how they count rent for serviceability and whether they accept projected rent from a letter by a local property manager. Your broker will know which lenders are comfortable with this and how to present conservative rental assumptions.

Self employed, contractors, and gig workers

If you run a business or consult, your income story is more complex than a payslip. Lenders often average your last two years of income and may add back depreciation and one off costs. Your broker will match you to lenders that accept addbacks that fairly reflect your cash flow. If the most recent year is stronger, some lenders can use that higher figure. For new ABNs with at least 12 months of trading, certain lenders may accept alternative documentation with higher rates. The goal is to design a path that gets you the property, then refinance to sharper pricing after another tax cycle.

Two tips make the biggest difference. First, keep your tax returns consistent with your application story. Large swings need clear notes from your accountant. Second, keep business and personal transactions clean in your bank statements. Underwriters look for tidy conduct.

Investment lending on the Coffs Coast

For investors, the math is simple but the policies are strict. Lenders usually shade rental income, load a vacancy factor, and apply higher assessment rates. That can cut capacity compared with an owner occupier purchase. A broker who models tax impacts and buffers will show you how the numbers work at different loan structures. They will also explain the trade off between interest only and principal and interest. In a falling rate environment, principal and interest with an offset can be effective if your cash flow is stable and you want to reduce debt.

If you are buying near the beach or in tourist pockets with short stay potential, ask your broker which lenders accept short term letting and on what terms. Some lenders are fine if your lease is at least 6 or 12 months. Others will not lend if the property is primarily short stay.

How to compare brokers in Coffs Harbour

Use these quick checks to evaluate fit.

- Do they ask detailed questions about your income, goals, and property before quoting rates.

- Can they explain APRA buffers and how they impact your exact borrowing power.

- Do they know NSW duty concessions and current federal guarantee settings relevant to first home buyers.

- Will they meet on weekends or after hours if your work schedule demands it.

- Can they share recent local valuation experiences for Coffs Harbour, Sawtell, and nearby suburbs.

- Do their reviews show consistent communication and on time settlements.

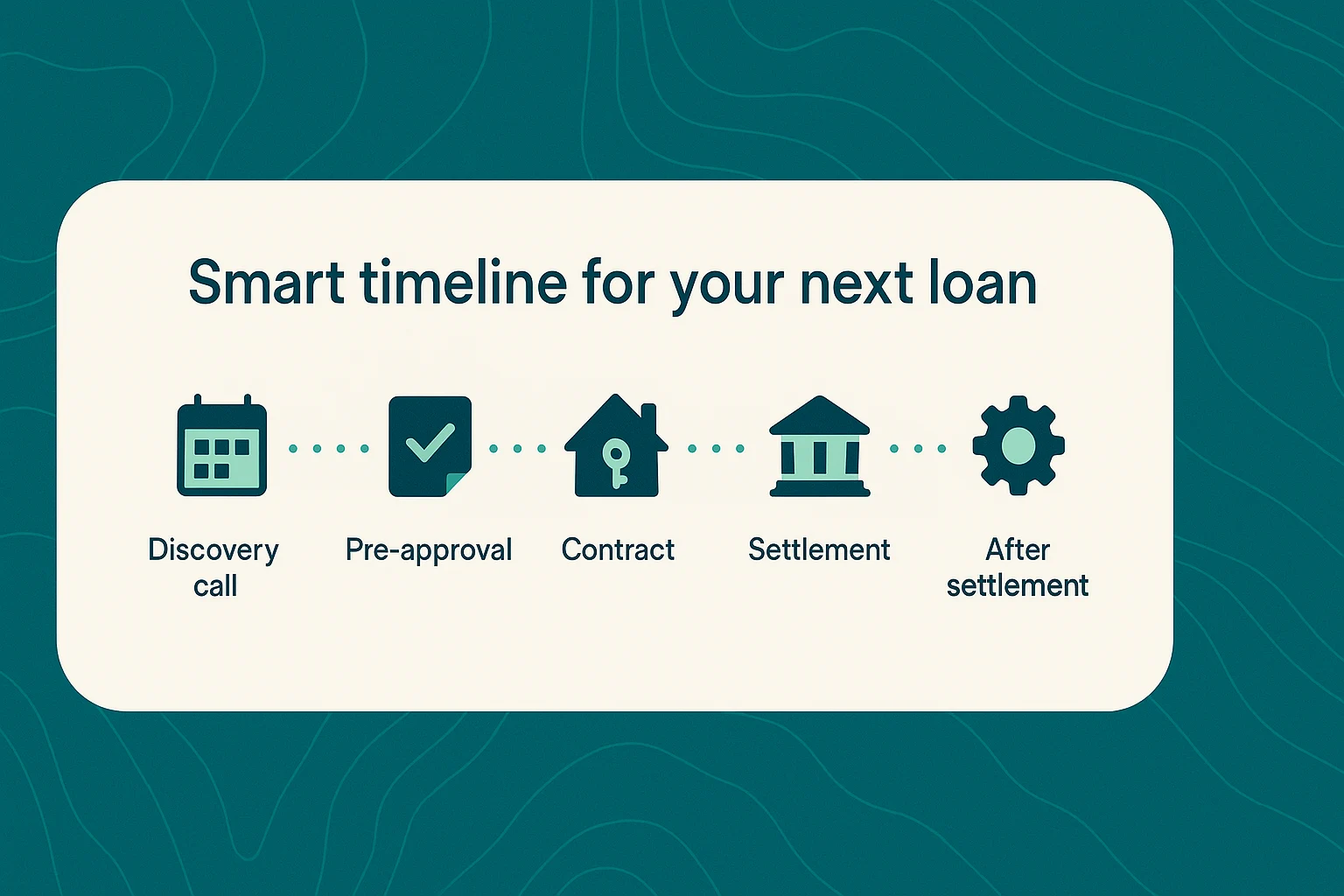

Smart timeline for your next loan

- Week 0 to 1: Discovery call, documents checklist, and quick scenario testing.

- Week 1 to 2: Lender short list, pre approval submission, and property search.

- Contract signed: Valuation ordered, conditions satisfied, and loan set to unconditional.

- Settlement: Your broker and conveyancer coordinate discharge and settlement day steps.

- After settlement: Set up offset, automate extra repayments, and schedule a rate review 12 months out.

Keep in mind that lender SLAs move with market volumes. A broker who deals with credit teams every day can often predict where timeframes will blow out and divert you early.

FAQ for Coffs Harbour borrowers

Who is the top rated mortgage broker in Coffs Harbour

Ratings shift over time. Use recent Google reviews and ask local agents who they see delivering on time. Focus on brokers who can explain policy and show you a plan, not just a rate.

Can I get a home loan with bad credit in Coffs Harbour

Possibly. A specialist lender may approve you with a higher initial rate if your recent bank conduct is clean. A broker can create a repair plan and set a timetable for a refinance once your conduct improves.

What are the best mortgage rates in Coffs Harbour right now

The best rate is the lowest total cost for your profile after fees and features. Your actual rate depends on deposit size, property type, and credit score. The RBA cash rate and lender funding costs set the backdrop.

Find a mortgage broker who works weekends in Coffs Harbour

Plenty of brokers offer Saturday meetings to align with open homes. Ask directly about weekend availability and turnaround times for pre approval.

How do I refinance my home loan in Coffs Harbour

Pull your current statements, ask for your lender’s price match, and ask a broker to benchmark it. Compare comparison rates and the three year cost after fees and rebates.

Mortgage broker for first home buyers in Coffs Harbour

Choose a broker experienced with NSW duty concessions and the federal guarantee so your deposit plan is accurate before you make offers.

Who can help with investment property loans in Coffs Harbour

Pick a broker who works often with investors, understands rental shading, and can model tax impacts alongside buffers.

Mortgage broker near Sawtell NSW

Ask for a broker who regularly funds properties in Sawtell and can share recent valuation examples for that postcode.

Is it better to use a mortgage broker or bank in Coffs Harbour

A broker compares many lenders and must act in your best interests when recommending a loan. A bank offers only its products. Many buyers speak to both, then choose the stronger overall offer.

Mortgage broker for self employed in Coffs Harbour

Look for a broker familiar with income addbacks, BAS seasonality, and alt doc policy so they can present your business story accurately.

Bring your plans to life

You are now ready to brief a broker with clarity. Define your budget, decide your must have features, and keep your documents clean. Ask your broker to model real costs, not just the headline rate, and to explain how APRA buffers, NSW duty settings, and federal guarantees intersect with your purchase or refinance in Coffs Harbour.

If you want a down to earth local team that services Coffs Harbour, Sawtell, Bellingen, and Woolgoolga, reach out to Rhythm Finance Co for an obligation free chat and calculators that make your next step simple. Visit Rhythm Finance Co.