Perth market snapshot and why a broker matters

If you are a first home buyer in Western Australia, the path to getting keys in hand looks exciting but complex. Prices, policies, and lender rules move often. A good perth mortgage broker filters the noise, compares lenders, and maps the exact steps to approval for your situation.

Let’s set the scene. Perth has been one of the country’s steadiest major capitals for activity, with tight rental conditions and solid buyer demand. The Real Estate Institute of Western Australia publishes regular market data that shows the latest median sale prices, rental prices, and vacancy rates for the metro area. Reviewing this data helps you calibrate budgets and timeframes before you dive into applications.

For first home buyers, the state and federal settings can materially lower your entry costs if you use them well. Western Australia’s First Home Owner Grant is a targeted payment for buying or building new property that you plan to live in, and it can pair with other concessions. Knowing which incentives you can claim, when they apply, and how they interact with your loan structure can save you thousands.

Working with a perth mortgage broker gives you access to a broad lender panel, faster shortlists, and a guide through valuation requirements, income verification, and settlement. A quality broker also explains trade-offs clearly, such as fixed versus variable features, offset availability, package fees, and how each impacts cash flow.

Key Takeaway

Start with market reality, then stack the right state and federal incentives on top. A perth mortgage broker can connect these dots and translate policy into borrowing power.

How to choose the right broker in Perth

Choosing a broker is not about a logo or a hot rate on a billboard. Use a simple, practical checklist.

1) Verify credentials and best interest duty. In Australia, brokers must operate under a credit licence and act in your best interests. The federal government’s Moneysmart resource explains what to expect, what questions to ask, and why you should see more than one loan option. Use it as your baseline for due diligence before you sign any paperwork.

2) Assess lender panel depth and product fit. A broad panel offers more choice, but you still need the right fit. Ask your broker to explain how each recommended loan suits your circumstances. For example, if you plan to renovate, you might want an offset account and redraw. If you expect pay rises, you may prefer flexible extra repayments without break costs.

3) Fee transparency and cost control. Most first home buyers do not pay broker fees because brokers are paid by lenders. Still, it is smart to ask plainly about fees, clawback periods, and any potential additional charges. The right broker makes costs easy to see and easy to compare.

4) Service and access. Many buyers work standard hours. Ask about weekend or after-hours appointments and whether the broker offers digital meetings and online document collection. If you live near Scarborough or Fremantle, look for a broker who can meet locally, or who services your area reliably. If you or a family member prefer Mandarin, ask if the broker or team can provide language support.

5) Reviews and track record. Read reviews, but scan for specifics. Look for detail about communication, speed, and how the broker solved problems. A pattern of clear updates and settlement support matters more than a few star ratings.

6) Clarity on refinancing path. A first loan is not final. You want a plan for two to three years out, including timed check-ins and rate reviews. This is vital if you start with a smaller deposit and plan to remove lenders mortgage insurance later.

Key Takeaway

Pick a broker on proof, not promises. Check licensing, panel strength, fee clarity, availability, and a clear plan for reviews and refinancing. Use the government checklist as your reference point.

WA incentives that first home buyers need to understand

Getting the structure right starts with knowing which WA and federal settings you can use.

First Home Owner Grant (FHOG) - WA The FHOG is a one-off payment for eligible buyers who buy or build a new home to live in. It helps with the upfront cost of entering the market and has specific eligibility rules. Using the official WA government guidance will help you confirm if your build or purchase qualifies and what documentation is required.

First Home Owner Rate of Duty (FHOR) - WA Stamp duty is often the single biggest upfront state cost. WA offers a concessional rate of duty for eligible first home buyers on certain home or land purchases. Check the government duty fact sheet to see thresholds, amounts, and alignment with FHOG eligibility so you can plan your contract dates and settlement strategy.

Home Guarantee Scheme - First Home Guarantee At the federal level, Housing Australia’s First Home Guarantee supports buyers who have a smaller deposit by providing a lender guarantee that can reduce or remove the need for lenders mortgage insurance. Policies and settings evolve, so always confirm current criteria, deposit requirements, and participating lenders before you apply. A perth mortgage broker can confirm which lenders on their panel participate.

How these interact with your loan Your loan pre-approval should factor in the timing of grants and concessions. The FHOG may apply at different stages for construction versus a purchase of a new completed home. Duty concessions hinge on price caps and eligibility. The First Home Guarantee involves reserve places and participating lenders. Your broker should sequence these so that application timing, building contracts, and settlement dates line up cleanly.

Example timeline for a new build

- Broker strategy session to confirm deposit path, FHOG eligibility, and duty position.

- Pre-approval with a participating lender if you plan to use the First Home Guarantee.

- Signed building contract for a new home or a fixed-price package with clear progress payments.

- Grant application lodged at the correct stage based on your build type.

- Settlement or first progress draw coordinated with the lender and builder.

Key Takeaway

Use WA’s FHOG and FHOR with the federal First Home Guarantee for maximum effect. Align timing and lender choice early so the benefits land where you need them.

What first home buyers should budget for

Even with grants and concessions, you will face costs beyond the deposit. Build a budget that is honest about every dollar.

Upfront items to plan for

- Deposit contribution.

- Stamp duty or concessional duty if eligible.

- Legal and conveyancing fees.

- Building and pest inspections for new unit purchases where relevant.

- Lenders mortgage insurance if you are not using a guarantee or do not meet deposit thresholds.

- Loan application, settlement, and package fees where applicable.

- Moving costs and initial home setup.

Ongoing items to plan for

- Repayments at a realistic rate buffer.

- Council rates, water rates, and strata levies if buying an apartment or townhouse.

- Insurance for building and contents.

- Maintenance and a small emergency fund.

Why buffers matter Income can vary, and properties can present surprises. Run your budget at a stress-tested repayment to avoid shortfalls. If you expect a pay rise, treat it as a bonus, not a safety net.

Mortgage features that help first home buyers

Offset account Parks savings to reduce interest on the principal while keeping funds accessible. Good for buyers who plan to build up cash again after settlement.

Redraw Lets you take out extra repayments if you need them later. Useful for renovations and small projects.

Split loans Combine fixed and variable portions. This balances payment certainty with flexibility.

Package discounts Some lenders bundle fee discounts and credit cards. Compare the total cost, not just the headline perks.

Cashback offers Short term sweeteners can be helpful, but check if the rate or fees offset any gains. Do the math over the first 2 to 3 years.

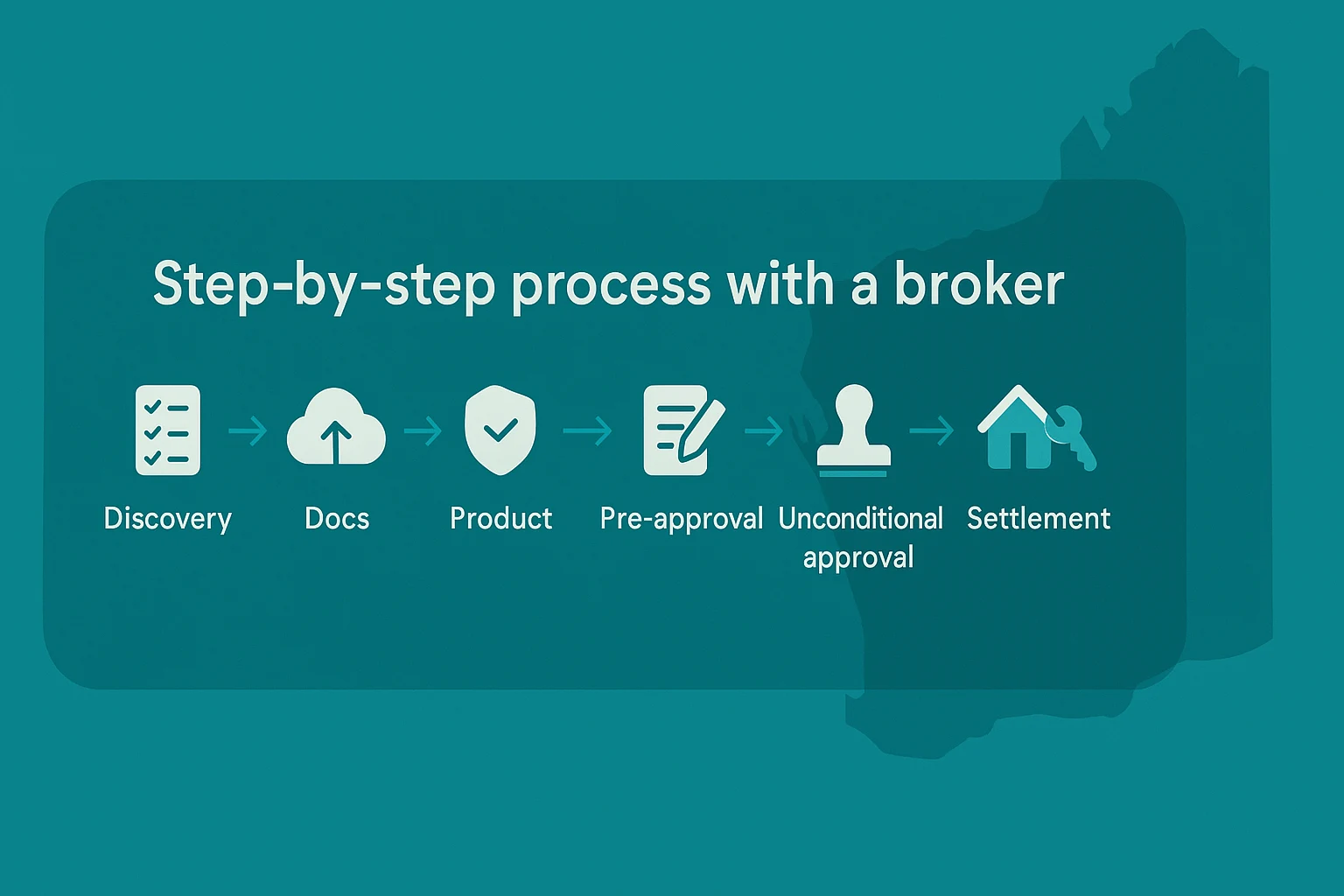

The step-by-step process with a broker

Here is a clean pathway you can follow with your broker from first chat to settlement.

1) Discovery and goals Set a target purchase price band, timeline, and location shortlist. If you are looking near Scarborough, Fremantle, or similar coastal hubs, talk through potential price differences and property types.

2) Document collection and verification Brokers typically use digital portals so you can upload securely. See the table below for a common first home buyer checklist.

3) Product selection Your broker compares suitable lenders and loan features and presents a short list. You review the trade-offs, then proceed to pre-approval.

4) Pre-approval Lender checks your income, expenses, and credit. Treat pre-approval as a limit, not a target, and keep your spending steady.

5) Offer and acceptance When you find a property, your broker coordinates the valuation and liaises with your conveyancer. If you plan to use FHOG or FHOR, make sure your timelines and contract type are consistent with eligibility.

6) Unconditional approval Final verification happens here. If you are in a tight finance clause window, updates matter. A switched-on broker will chase any missing items fast.

7) Settlement and move-in Your broker and conveyancer work with the lender and agent to settle on time. You get your keys, set up offset accounts and banking, and plan a 6-month review with your broker.

Your document checklist for a smooth approval

Below is a practical checklist most first home buyers in WA will need. Tick items off as you go and keep digital copies ready.

| Document type | Examples | Who provides it | Why lenders need it | Tips for first home buyers |

|---|---|---|---|---|

| Identification | Passport, driver licence, Medicare card | You | To verify identity and meet legal requirements | Ensure names match across all IDs |

| Income evidence | Latest 3 payslips, recent PAYG summary | You and employer | To confirm stable income | If casual or contract, provide longer history |

| Bank statements | 3 to 6 months of everyday and savings accounts | Your bank | To verify spending patterns and savings | Keep accounts tidy during pre-approval |

| Deposit source | Savings history, gift letter if applicable | You and any gift provider | To confirm genuine savings or gift rules | Ask your broker about genuine savings rules |

| Debts and liabilities | Credit card limits, personal loans | You | To calculate serviceability | Reduce limits you do not need before applying |

| Property details | Offer and acceptance, build contract | Agent or builder | To verify security and value | For new builds, include progress payment schedule |

| Insurance | Building insurance quote | You or insurer | Required for settlement on houses | Arrange early to avoid settlement delays |

| Grants and concessions | FHOG application, duty forms | You and broker | To align finance and incentives | Lodge at the correct stage for buys vs builds |

First home buyer tactics for Perth suburbs

Calibrate your target suburbs Look at distance from work, transport, and lifestyle amenities. Coastal areas like Scarborough carry premium pricing during strong markets, while satellite suburbs often provide more entry-level stock. Check recent median price trends and listings to match budget and property type. The REIWA Perth Metro data hub is a good starting point when you are assembling a shortlist.

Balance unit vs house choices Some first home buyers enter via a townhouse or unit to get location benefits with a lower initial price point. If you choose a strata property, budget for levies and special levies, and review strata minutes.

Lean on schemes when they suit If you plan to build, consider how the FHOG applies. If you have a smaller deposit, the First Home Guarantee may help you avoid lenders mortgage insurance. Always confirm current criteria and participating lenders.

Investors-in-waiting If you plan to turn your first home into an investment in a few years, structure now for later. Ask about offset flexibility, extra repayment rules, and the refinance path once your equity grows.

Service, access, and language support

Life is busy. Many modern brokers offer fully digital processes with bank-grade portals, electronic signatures, and mobile upload for documents. This pairs well with weekend or after-hours consultations so you do not have to take time off work.

If you prefer in-person guidance, ask for a Perth-based broker who can meet near your area. For buyers in Scarborough or Fremantle, proximity can help with local property insights and agent relationships. If you or your family speak Mandarin, check if the broker can provide Mandarin-speaking support for key conversations so that decisions are clear and confident.

Key Takeaway

Pick a service style that fits your life. Digital or face to face, weekday or weekend, English or Mandarin, the right broker matches how you prefer to work.

Costs, fees, and how brokers get paid

Most perth mortgage broker services for first home buyers are paid by the lender. That means you usually do not pay a direct fee, but always ask for a written outline. Confirm any scenarios where a fee could apply, such as complex credit situations or commercial elements. Also ask about clawback periods, which are rules that can see a broker’s commission reduced if a loan is closed or refinanced within a short window. A transparent conversation up front removes surprises later.

For rate comparisons, focus on the real cost. A product with a slightly higher rate but better offset flexibility may save you more over three years if you plan to hold a healthy savings balance. Your broker should show side-by-side comparisons with total cost over time, not just the first year headline.

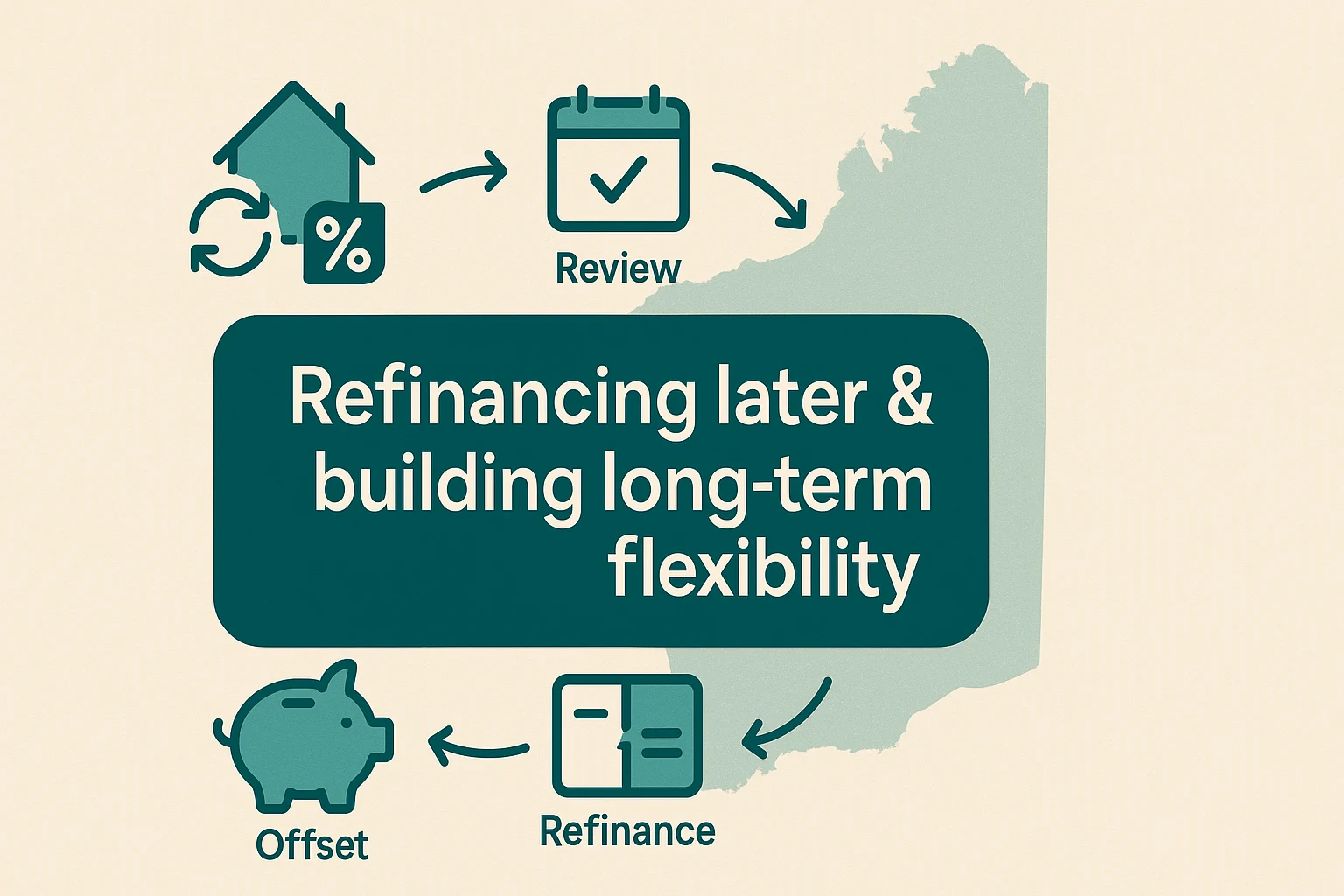

Refinancing later and building long term flexibility

Your first loan is a start, not the finish line. Lock in a review schedule with your broker at 6 months and 18 to 24 months. If your equity improves, you may drop lenders mortgage insurance in a refinance. If your income grows, you might switch to a product with better offset features or lower package costs. Keep notes on what works well for your cash flow and what you want to change so your next review is efficient.

What if you have bad credit or a thin file

First home buyers are not always textbook borrowers. Missed payments from years ago, a short credit history, or a mix of contract and casual work can make approvals harder. A broker can still build a case. You may need more supporting documents, a slightly larger deposit, or a product with tighter conditions for the first year or two. The key is to disclose facts early so your broker can shape a plan that fits lender policy.

Essential Perth-first-home FAQs

Who is the best mortgage broker in Perth for first home buyers?

The best choice is the broker who proves they can match your goals, explain trade-offs clearly, and deliver on time. Use the Moneysmart questions as your checklist, ask about panel depth, and read detailed client reviews rather than only star ratings.

Can I get a mortgage broker in Perth that works weekends?

Yes. Many brokers offer weekend or after-hours meetings. Confirm options during your first call and ask about digital portals for document uploads.

Which Perth mortgage broker has the lowest fees?

Most first home buyers pay no direct broker fee. Still, ask for a written fee policy so you know where exceptions may apply.

How do I choose a mortgage broker in Perth WA?

Check licensing and best interest duty, review the lender panel, ask for at least two loan options with a written comparison, confirm availability, and set a refinance review plan. Use the federal government’s guidance as your benchmark.

Mortgage brokers near Scarborough WA with good reviews?

Look for Perth brokers who service that area regularly and can meet in person or online. Read reviews that describe communication and settlement support in detail.

Find a mortgage broker in Fremantle WA for investment property.

Many Perth brokers service Fremantle and can advise on investment structures. Ask about interest-only options, offset, and future refinances.

Are there mortgage brokers in Perth who speak Mandarin?

Yes. Ask during your enquiry. Many teams can accommodate Mandarin-speaking clients or arrange interpreters.

What documents do I need for a home loan in Perth?

See the checklist in this guide. In short, ID, income, bank statements, deposit proof, details of debts, and contract documents.

Best mortgage broker for refinancing in Perth WA.

Look for brokers who offer proactive reviews and can model savings over time, not just a headline rate.

Can a mortgage broker help with bad credit in Perth?

Yes. Disclosure and planning are vital. You may need a larger deposit or tighter conditions initially while you rebuild your profile.

Using grants and concessions without stress

Let’s tie it together. WA’s FHOG supports new builds or new purchases that you will live in. Coordinate your build contract or purchase contract with the grant process so funds are available at the right time.

Pair that with the First Home Owner Rate of duty if you meet price and eligibility requirements. The duty bill is often your biggest state charge, so confirm the threshold and how it applies to your property type before you sign.

If you need to stretch your deposit, check the First Home Guarantee. A participating lender may accept a lower deposit without lenders mortgage insurance because of the government guarantee. Policy settings change over time, so confirm eligibility and lender participation before you start house hunting. A perth mortgage broker will manage this sequencing and help you avoid timing errors.

Key Takeaway

Plan your incentives like a timeline. Grant, duty, and guarantee settings need the right documents and the right contract dates. Your broker’s job is to make that plan simple.

Putting it all into action

Here is a simple action plan you can follow this month.

Week 1 - Clarity

- Confirm budget ranges that fit your savings and income.

- Choose your perth mortgage broker and agree on a target settlement month.

- Decide if you will chase a new build to use the FHOG or focus on new completed stock.

Week 2 - Documents and shortlist

- Upload ID, income, bank statements, and deposit evidence.

- Review a short list of loans that fit your goals.

- Decide on must-have features such as an offset account.

Week 3 - Pre-approval and property

- Obtain pre-approval and refine your suburb shortlist.

- If you are looking near Scarborough or Fremantle, walk recent sales and talk to local agents so you know contract pace and common conditions.

- Line up your conveyancer and inspections plan.

Week 4 - Offer and next steps

- Make offers within your pre-approval limits and manage conditions tightly.

- Begin grant or concession applications based on your pathway and contract type.

- Confirm insurance and plan your move.

Key Takeaway

Momentum matters. Break the buying journey into four weekly sprints so you can make steady progress without overload.

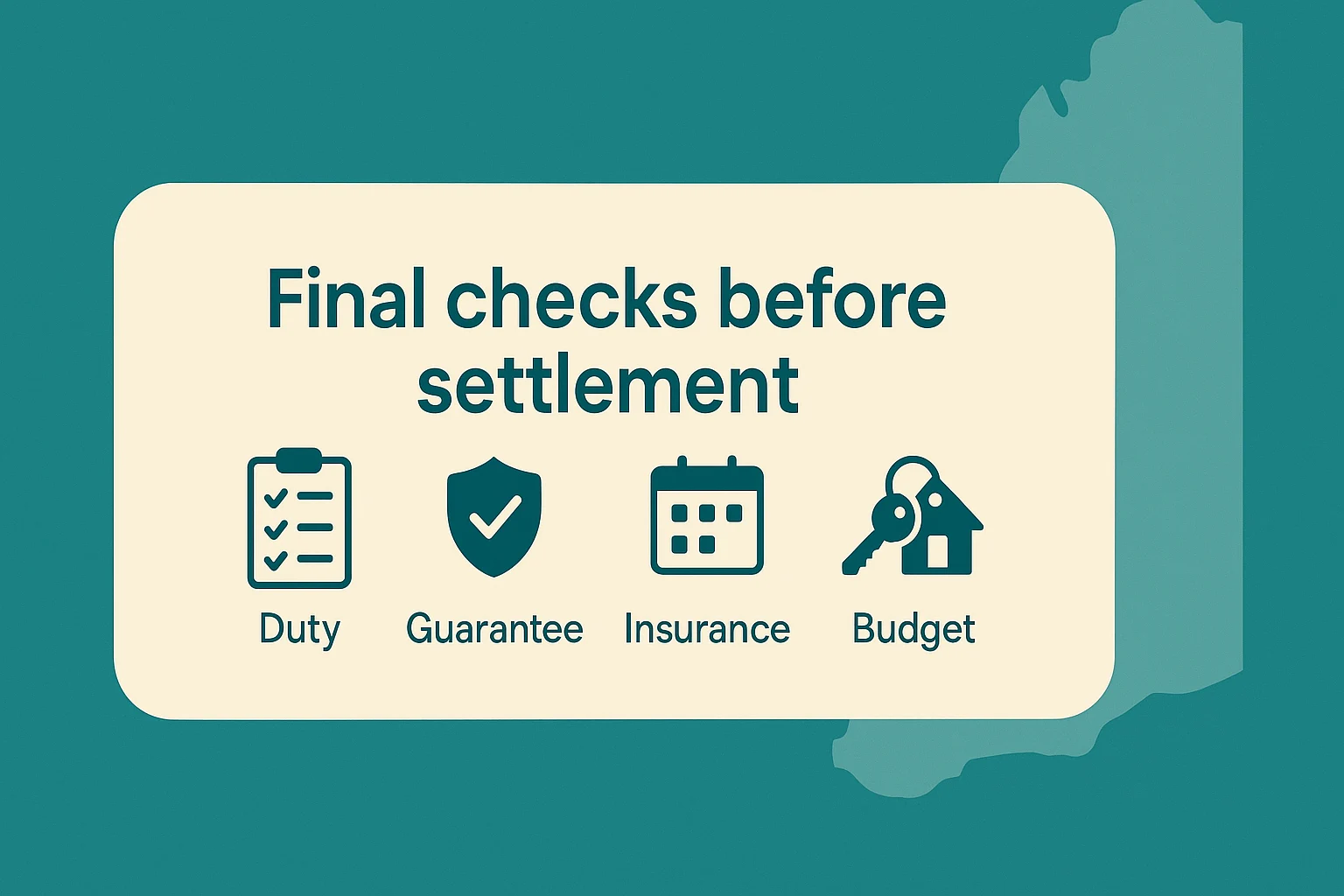

Final checks before settlement

- Reconfirm your duty position and any concessions to avoid last minute bill shocks.

- If using the First Home Guarantee, reconfirm with your lender that the guarantee place is secured and your documents are complete.

- For new builds, verify the grant stage rules one more time to ensure the FHOG funds or approvals line up with your schedule.

- Test your post-settlement budget at a slightly higher repayment so you have a comfort buffer.

- Set calendar reminders for 6-month and 18 to 24-month broker reviews.

Why local expertise is worth it

Perth has unique rhythms. Suburbs can move at different speeds. New build stages carry extra paperwork. State concessions and federal guarantees have their own timing quirks. A perth mortgage broker who lives and works locally can spot issues early, prep documents the way local lenders prefer, and coordinate with Perth-based agents and conveyancers quickly. That reduces risk and lowers stress so you can focus on the fun parts of getting your first home ready.

Ready to get started?

You do not need to figure this out alone. A broker can translate complex rules into a clear plan that fits your life, and can keep you on track from pre-approval to settlement.

Want a friendly, award-recognised team to map your first-home path in Perth? Top Mortgages offers digital or in-person service, a wide lending panel, and step-by-step guidance from approval to settlement. Check out their process, awards, and recent client feedback, then book a chat today.